For company house owners, the Roth IRA may possibly be a incredibly eye-catching savings car.

Roth IRAs and 401(k)s (termed DRAC, or Selected Roth Account) are typical prosperity-accumulation applications. There are many means to benefit from a Roth, and they give major financial preparing chances, notably the elimination of Essential Minimal Distribution (RMD) friction (‘tax friction’) and the protracted compounding period of time of the joint lives of the Roth owners additionally 10 many years, thanks to the Secure Act. Roths have some major attributes:

· All capable earnings are tax-absolutely free

· There are no Necessary Bare minimum Distributions (RMD) to the owners (if the Roth 401(k) is rolled into a Roth IRA)

· An inherited Roth (for inheritances soon after 2019) may possibly be withdrawn up to 10 years after the death of the owner

There are two principal strategies to fund a Roth, both by contributing (e.g., contributory Roth IRAs, back again-doorway Roth or DRAC) or by converting an current RIA (or in some scenarios, 401(k) to a Roth by paying out the taxes on the conversion). These characteristics can give important rewards, specially if the tax amount at the time of conversion is reduced than the future tax charge at the time of distribution.

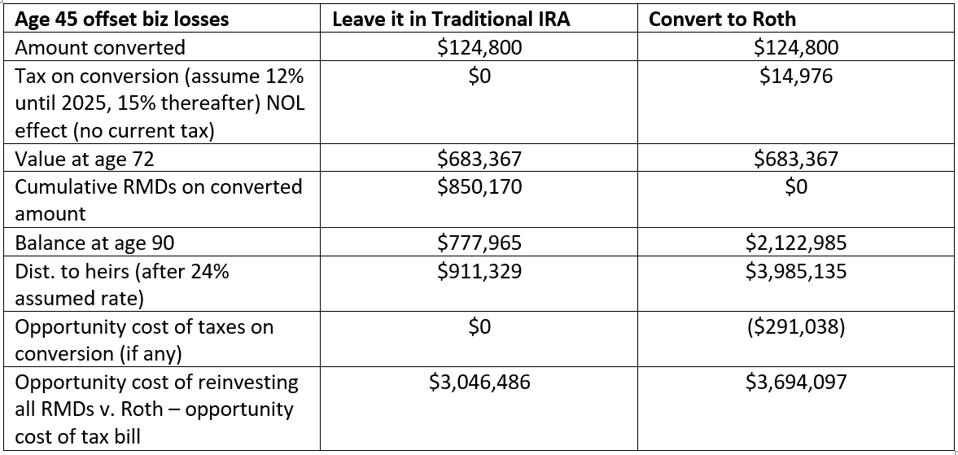

Business operator with 2020 losses. Suppose our conversion prospect is a 45-year-previous organization operator who experienced a terrible 2020 (no surprise right here). Permit suppose Randy and Gail have a cafe that was minimal in 2020 and they generated a loss of $100,000. They could theoretically convert $124,800 with no taxes (although they would use up their NOL tax rewards). What would a $124,800 conversion search like for a 45-yr-old?

Comparison is crucial, the quantities do not lie.

In addition, some enterprise entrepreneurs may well have gotten a Paycheck Security Program (PPP) Personal loan, which delivered further cash.

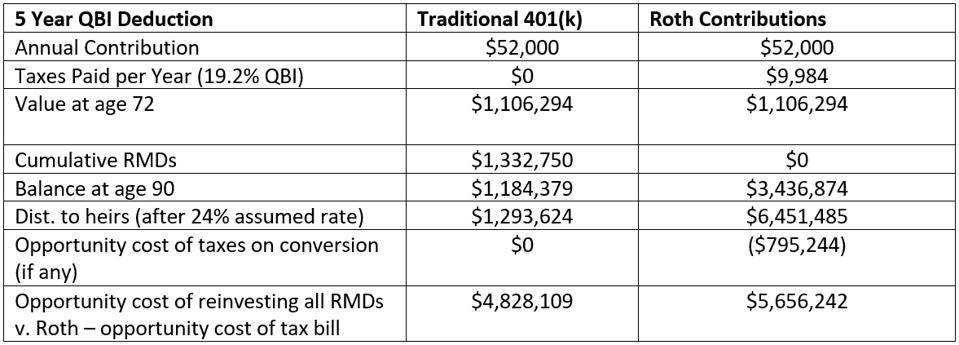

The Tax Cuts and Work Act Biz-Operator Conversion: Get a QBI deduction on the Roth. Listed here is a massive one particular. Company house owners with ‘pass-through’ entities can use a ‘Qualified Business Income’ (QBI) deduction of 20% of the QBI. Consequently, a business operator with $100,000 of QBI can get a $20,000 deduction. Some company proprietors in ‘Specified Provider Trade or Business’ (SSTB) like medical doctors, lawyers, actors, and CPAs can use the QBI deduction on go-as a result of revenue as properly, but have a restrict on the QBI deductions centered on their taxable incomes ($326,600 for married submitting jointly and $163,300 for other folks). Utilizing a Roth 401(k) as a substitute of pretax 401(k) can produce a deduction rather of a deferral. In addition, the QBI deduction expires at the finish of 2025. A married pair of veterinarians earning $270,000 of QBI are in about a 19.2% price. In 2026, they’ll go again to 33% (or extra). So, if our 50-12 months outdated couple helps make Roth 401(k) (DRAC) contributions of $26,000 ($52,000 complete) every for decades 2020 by way of 2025, and they produced 6.50% on their investments, here is what we may well hope to see:

If you might be a company owner, your QBI deduction could be place to fantastic use with a Roth IRA.

By conserving into the DRAC more than the following 5 a long time they are in a position to supply their heirs with over $800,000 in further belongings. What do they do in 2026? Go back again to preserving on a pre-tax basis. Business enterprise owners with QBI should really diligently look at irrespective of whether the benefit of the QBI deduction would make a Roth tactic a lot more effective in their situation.

Bottom Line: Enterprise entrepreneurs will need to sharpen their pencils (or polish their spreadsheets) as we close out 2020, but these two suggestions can assist make lemonade from lemons. If you want more facts, obtain our cost-free e-e-book on IRAs, up-to-date for 2020. As usually. I’ll check out to respond to questions at [email protected].

More Stories

Sales Build in November as Inventories Grow

A Two-Way Communication Tool for Teachers

My 50th birthday celebrations in Amsterdam