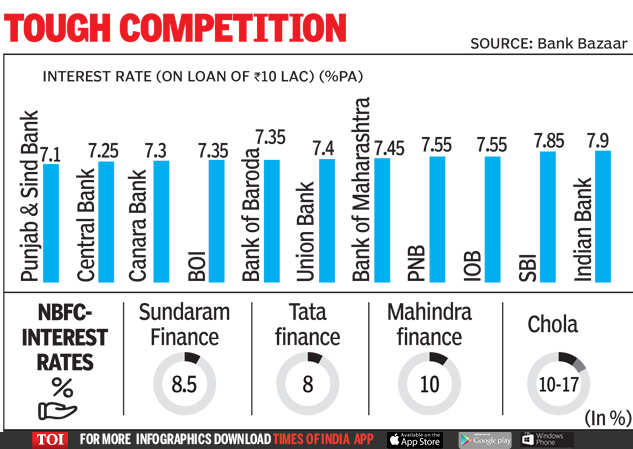

When State Lender of India (SBI) is providing automobile loans starting from 7.7%, some others are even less costly with Central Lender of India providing loans at 7.25%, followed by Canara Bank (7.3%), United Bank of India (7.4%) and Indian Overseas Financial institution (7.55%). “In the latest periods, NBFCs have dropped current market share to PSU banks, which have become much more aggressive and that features Tata Motor Finance,” said Tata Motors team CFO P B Balaji. Unlike banks, NBFCs count on wholesale funds. Banking companies are now heading gradual in lending to finance companies with RBI encouraging banks to acquire the co-lending design to consider gain of NBFCs’ network.

According to M Ramaswamy, chief economic officer at Sundaram Finance, banks are flush with liquidity and can carry down premiums. “We are experiencing strain in some markets, dependent on how intense they switch. It is a blended bag for us — we primarily cater to persons with bigger hazard profiles and mainly because of our excellent scores, our expense of cash has also arrive down. So, in particular areas, we have misplaced marketplace share and in other individuals, we have gained,” he stated.

Sundaram Finance saw a 20% gap in loan disbursements in the September-ended quarter, 2020. Cholamandalam Investment & Finance Organization (CIFC) noticed full disbursements drop by 30% year-on-12 months in its vehicle finance section for the quarter-finished September 2020, in accordance to research studies of brokerage business Motilal Oswal. This excludes the tractor and development gear (CE) segments.

Shriram Transportation Finance disbursed ₹650 crore of loans, which was fifty percent of very last year. Also, 97% of disbursements ended up in the employed vehicle phase. “Our aim is on individual and modest truck homeowners who want to purchase employed vehicles. Generally, banks do not lend to utilized motor vehicles since it is time-consuming, needs car valuation and ownership transfer paperwork,” stated Umesh Revankar, MD & CEO, Shriram Transportation Finance.

More Stories

Best Time to Visit the Dominican Republic

4 Practical Tips for Traveling Internationally With an Infant – MotherhoodLater.com

How to Get A Car From 1800 Charity Cars Donation-