For larger value spots, such as the District and encompassing counties, the FHFA conforming mortgage limit will be $822,375 following yr, up from $765,600 this calendar year.

The Federal Housing Finance Company has established conforming loan limitations for mortgages that can be purchased by Fannie Mae and Freddie Mac for 2021, and the limits have been greater for the fifth consecutive year.

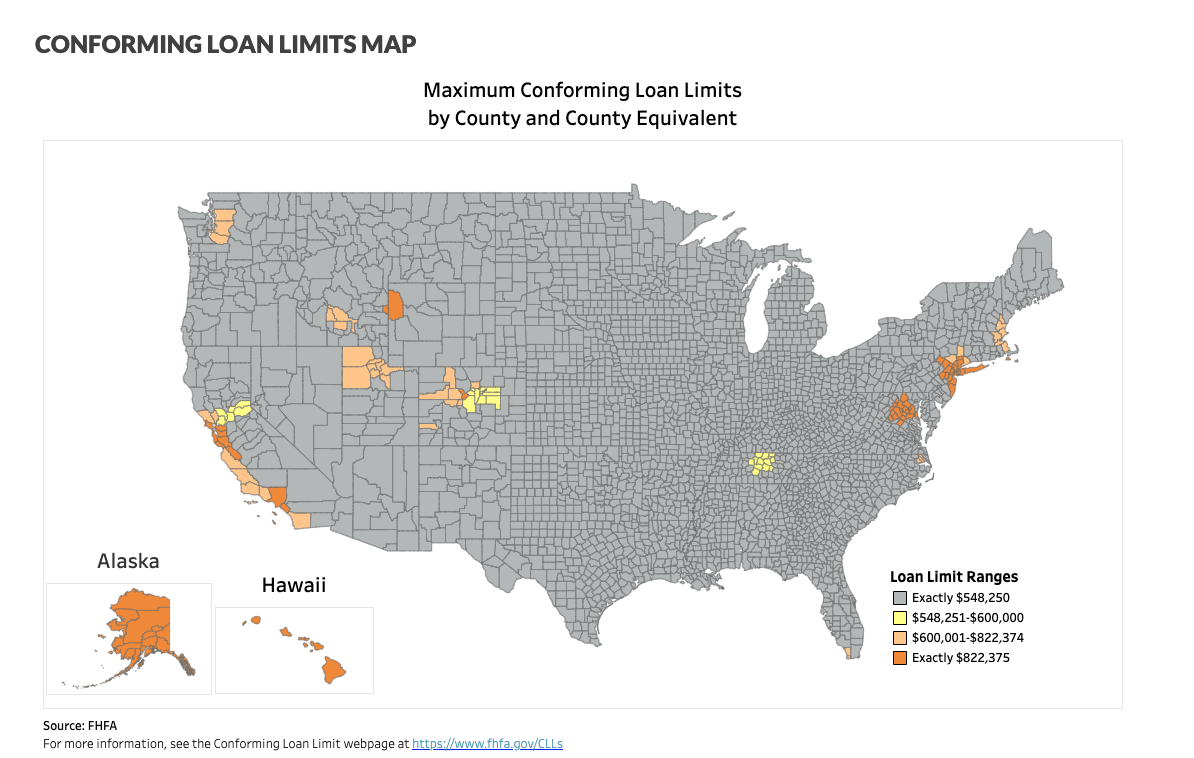

The conforming bank loan limit for just one-device houses in 2021 will be $548,250, an boost from $510,400 in 2020.

For larger charge parts, which includes the District and encompassing counties, the restrict will be $822,375 upcoming 12 months, up from $765,600 this yr.

FHFA sets conforming personal loan limitations based on countrywide household cost boosts, which rose 7.42% amongst the 3rd quarters of 2019 and 2020. The improve in loan limits matches the increase in residence charges.

Significant-cost locations are individuals in which 115% of the regional median residence benefit exceeds the baseline conforming bank loan restrict. The substantial-price place conforming restrict is capped at no additional than 150% of the baseline financial loan restrict.

Greatest conforming loan limitations do not use to every county or county equivalent in the state, but FHFA says it will utilize to all but 18 counties in 2021.

The $822,375 conforming financial loan restrict in the Washington spot applies to each county and county equal in both Northern Virginia and suburban Maryland.

Under is a map showing counties nationwide by 2021 conforming financial loan limits from FHFA:

More Stories

Sales Build in November as Inventories Grow

A Two-Way Communication Tool for Teachers

My 50th birthday celebrations in Amsterdam