DXC Technology Inc. (DXC) , a company of digital information and facts technology services, has observed its stock trade bigger considering that its reduced in March however its shares are even now nicely under wherever they begun 2020. In mild of this gradual and constant recovery, let’s check and see if the climb can carry on or even speed up.

In this updated day-to-day bar chart of DXC, under, we can see how costs were slash down sharply back in January until eventually the middle of March. DXC produced a minimal with the movement of the broad industry and we can see a basic retest in early April as selling prices pulled back ahead of going bigger. DXC has created a range of sideways consolidation designs this year and the buying and selling quantity has been largely continuous for the earlier six months. The On-Equilibrium-Quantity (OBV) line produced its reduced in late March and now demonstrates bigger lows and increased highs for the 12 months. This tells us that consumers of DXC have been far more aggressive and the advance is possible to keep on. The trend-adhering to Shifting Regular Convergence Divergence (MACD) oscillator has been hugging the zero line for much of the year but it has been displaying far more power considering that November.

In this weekly bar chart of DXC, beneath, we can see that prices experienced a substantial drop from 2018 to 2020. Rates have finally crossed earlier mentioned the 40-7 days relocating normal line and the slope of the line is now constructive. The OBV line has enhanced but it is not a one particular-way increase. The MACD oscillator is bullish as it crossed earlier mentioned the zero line in late November.

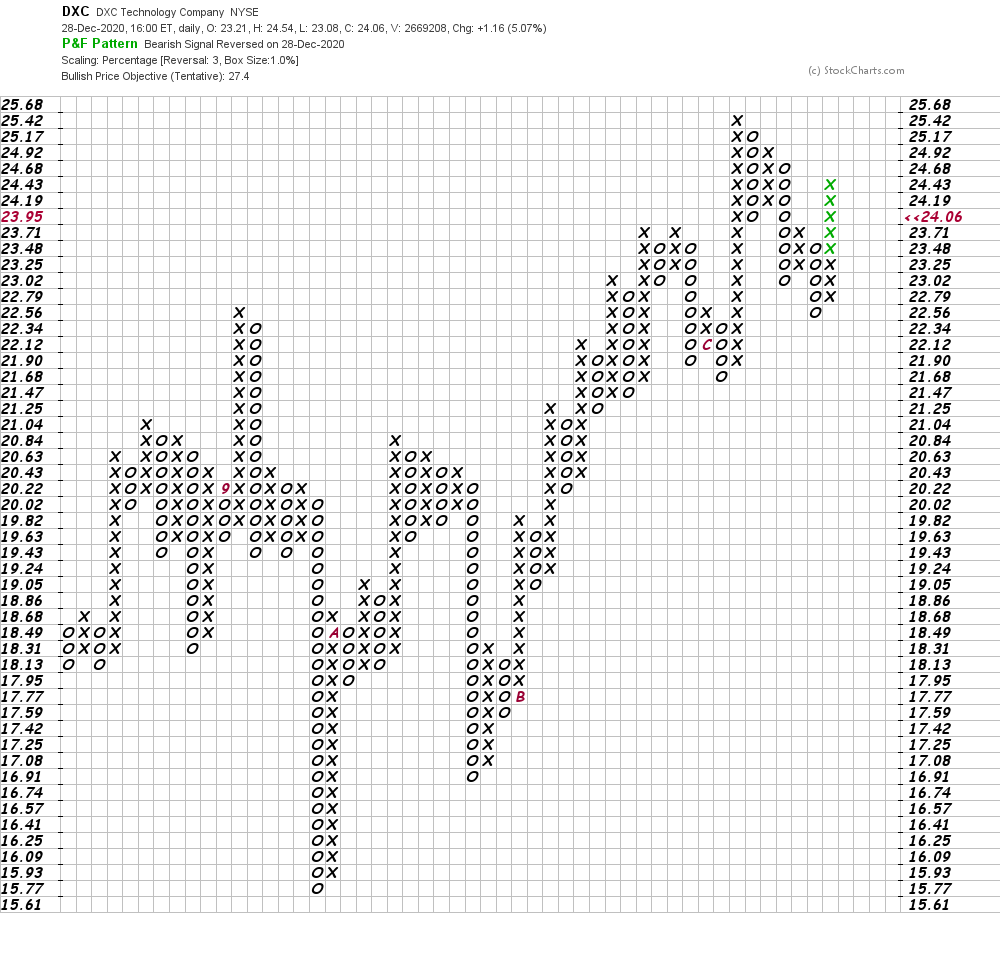

In this each day Stage and Determine chart of DXC, underneath, we can see an uptrend with a opportunity selling price concentrate on in the $27-$28 location.

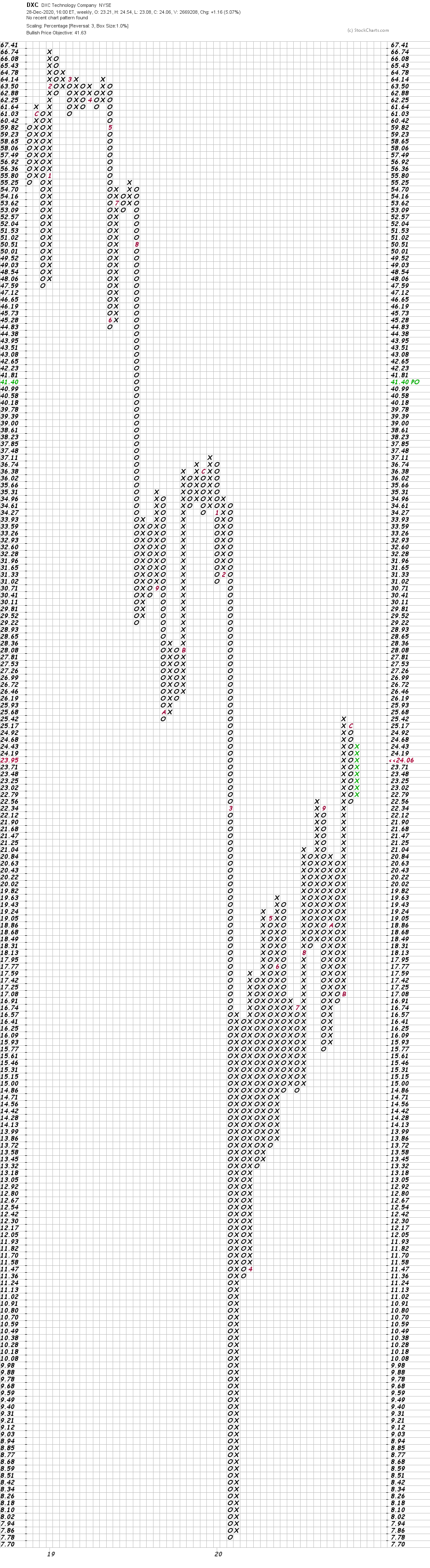

In this weekly Point and Figure chart of DXC, down below, we can see a projected price tag focus on in the $42 space.

Base line technique: Traders could go lengthy DXC about present degrees, risking under $20 for now. The $40-$45 space is our price objective for 2021.

Get an e mail warn each time I compose an post for True Revenue. Click on the “+Observe” upcoming to my byline to this report.

More Stories

eSIMs for Tourists of India

(CETX), (CSCW) – 12 Details Technological know-how Shares Relocating In Wednesday’s After-Current market Session

(BRQS), (CLSK) – 12 Information Technologies Shares Moving In Wednesday’s Right after-Market place Session