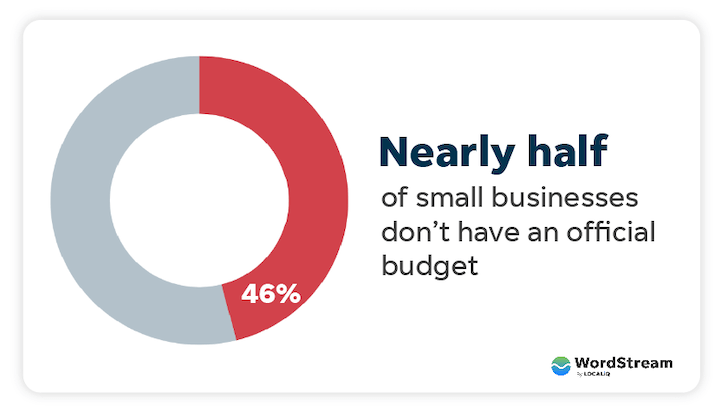

If you want to be effective in enterprise, then you will need to know in which every dollar goes. It’s not sufficient to have a tough idea—it needs to be on paper. Which is the place a business enterprise spending plan comes in. But according to a review by Clutch, 46% of compact companies do not have a declared price range. That is just about 50 percent 😮.

Budgeting can be intimidating, but never worry—you really don’t require a economical or accounting background to produce a tiny business spending budget. In this put up, I’m likely to protect all of the budgeting principles you will need to know, demonstrate you how to build a smaller small business price range, and then supply templates so you are not starting up from scratch.

Desk of contents

Why you want a compact enterprise spending budget

In a nutshell, budgeting forces you to target on your business enterprise goals and serves as a compass to know if you are headed in the suitable route. In addition, every single enterprise goes through economic fluctuations above time. Budgeting will help you navigate these, from late payments to receiving the rug pulled out from underneath you. Here are the essential gains of getting a small small business funds:

- Financial wellbeing test. It allows you know if you have ample money for producing income, operating expenses, and enlargement.

- Achieve extended-phrase goals. Know regardless of whether you have to have to minimize expenditures or boost earnings to accomplish your strategic, operational, and fiscal targets.

- Expand your company. Traders or creditors will first glimpse at your cash flow and expenditures prior to investing in you.

- Sustain financial protection. It aids continue to keep the doorways open up in circumstance of a recession, off month, a downturn, sluggish payments, and delayed checks.

- Capitalize on chances. With a finances in area, you will not miss out on out on any useful possibilities for profitability.

Knowing how a great deal income is coming in and going out allows you to give each penny a “job” and use every greenback to your business’s greatest gain.

How to develop a small small business spending budget in 6 measures

Now that you comprehend how crucial a spending budget is, here’s how you can produce one so you can guarantee smooth organization operation and facilitate economical cash movement:

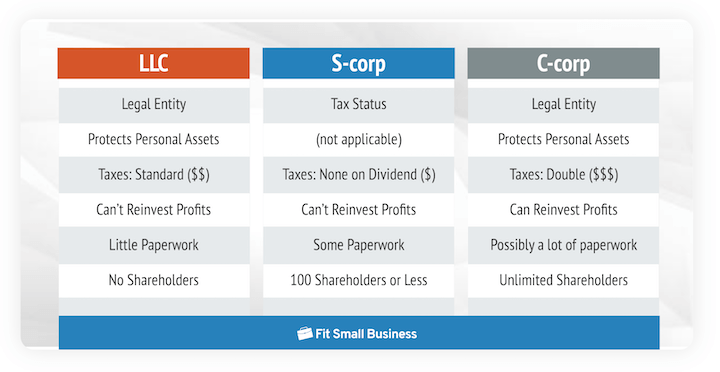

1. Different your company finances from your particular finances

This is a person of the cardinal procedures to thrive in company. It’s tempting for smaller business proprietors to combine organization and own finances, but it pretty much constantly prospects to disaster. Catastrophe in a few kinds:

- Stagnation: Without an accurate perspective of your monetary position—that is, how the business enterprise is undertaking with regard to its objective, you are not very likely to development.

- Taxation: It aids you regulate items like business costs for taxation purposes

- Litigation: Mixing budgets blurs the authorized line among you (the business owner) and your enterprise. It shields you from liabilities and your personal belongings in situation of litigation

But how do you do that? In this article are a few of methods you can consider when developing your funds.

- Utilize for a business enterprise checking account and credit rating card.

- Use separate accounting systems for particular budgets and company finance

Separating the two allows you treat your smaller enterprise like an unbiased entity. Apart from tax benefits, you set your organization up for greater revenue margins. Take note also that minority-owned corporations can sign-up as a minority business enterprise enterprise to acquire extra help.

2. Set apart a contingency fund for emergencies

Murphy’s legislation states, “Anything that can go erroneous will go mistaken.” Which is why you really should set aside a contingency fund for your company.

If this isn’t the 1st organization you’ve started, you know you will always get shock costs when you minimum hope it. For instance, let us say you run a printing small business. Then appropriate right after getting a everyday living-modifying contract, your principal printer breaks down ahead of you even start off. Which is when a contingency fund will save the working day.

A contingency fund for emergencies will safeguard your business enterprise when these sudden charges crop up. So though it is tempting to spend that extra revenue to obtain that new MacBook you really do not need, never do it. For now, established apart some of that income. A good rule of thumb is to set apart 3 to six months of your compact business running expenses.

It will prepare you and your company in situation 1 of your pieces of gear breaks down, or you want to exchange it. Of training course, you could generally consider out a financial loan, but it would not damage to have a lot more alternatives.

3. Recognize your income streams

Grant Cardone likes to say “Cash stream is king.” Where does your money appear from? How considerably and how typically does it appear in? For modest small business budgeting to get the job done, you should have the answers to these inquiries.

That means tallying all your revenue (not financial gain) sources every thirty day period. In circumstance you really don’t know the big difference involving profits and profit, revenue is all the funds your business generates prior to expenses. Following subtracting expenditures, then you’re still left with a revenue.

Sum up your profits for the year and divide it by 12 to locate your month-to-month revenue or income. Utilizing this info, you can appear at how your profits modifications over time. This will assist you come across and take care of seasonal designs and downturns.

4. Decide your set costs

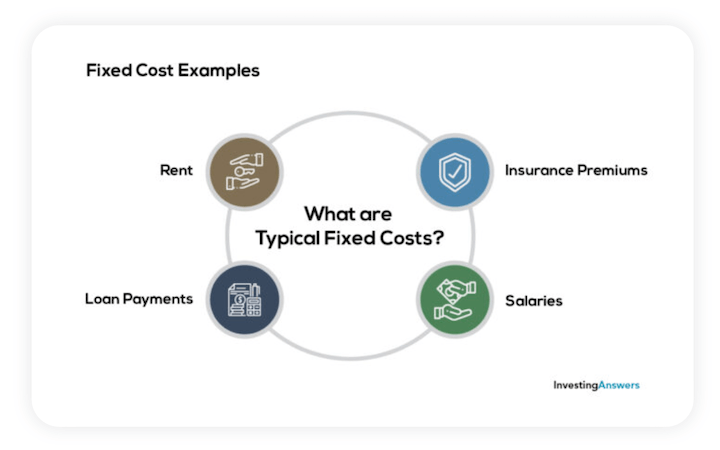

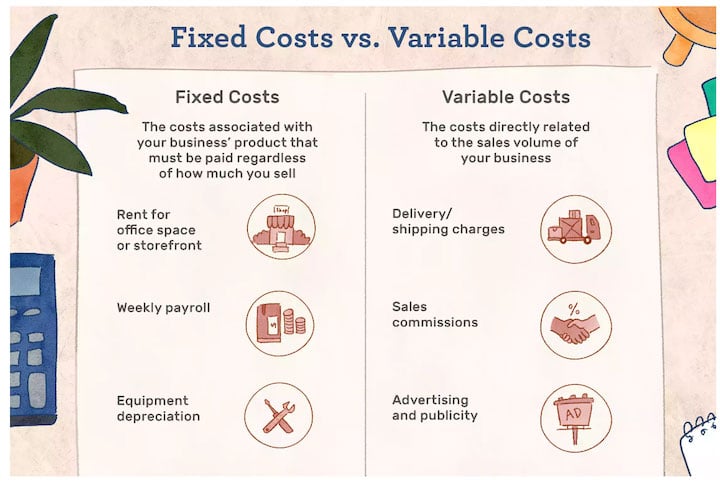

The subsequent phase in making a modest organization spending budget is to include things like all your fixed prices. Fixed expenses are recurring expenditures that are important for your small business operations. These running expenditures both occur up each individual working day, 7 days, month, or calendar year. That involves anything from hire, debts, utilities, and payroll charges to taxes and insurance coverage.

That said, no two companies are the exact same. So acquire some time to identify any other fastened expenditures needed to run your enterprise. At the time you have identified them, sum them up to get a precise determine of your set costs on a month-to-thirty day period basis. If your business is new, then you can project these values.

But ensure you variable in these month to month charges as element of your small business spending plan. That way, you can set apart funds to cover them. At the time you have accomplished that, the next stage is subtracting them from your profits.

5. Decide your variable costs

As you went by your preset expenses, you in all probability noticed other inconsistent charges in your small business. These inconsistent costs are known as variable costs or bills for the reason that they adjust depending on how you use them. They include utilities, promoting charges, specialist enhancement , supplies, your wage, and so forth.

For illustration, you may possibly increase production charges to get extra uncooked supplies to match the expanding popularity of particular goods. Or if you are working a SaaS small business, you may well require to commit more price range in certain seasons to get a lot more purchasers.

Discretionary expenditures

Discretionary bills are also regarded variable fees simply because while they are wonderful to have, they’re not crucial for your small business. These include items like instruction, consulting, and many others., which may possibly support improve profitability.

You want to lower your variable expenses in lean months, setting up with discretionary expenses. And when your profits are on the uptrend, you can allocate more revenue to variable costs to support you increase a lot quicker.

Tally all your variable fees at the conclusion of every thirty day period. This paints a crystal clear photograph of how they fluctuate based on small business overall performance so you can make accurate predictions.

6. Create a income and loss statement

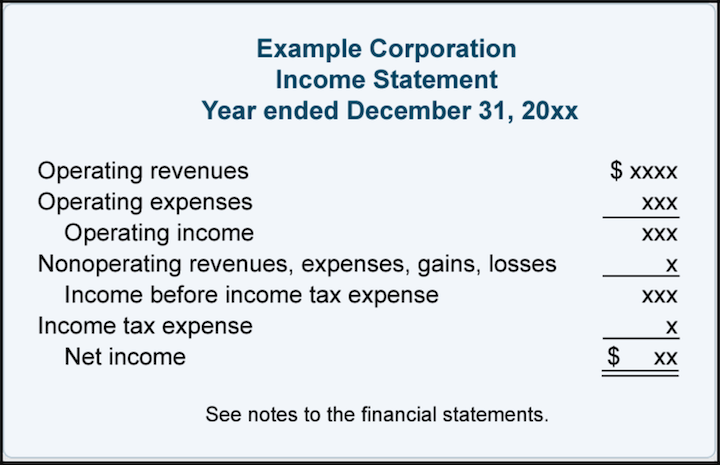

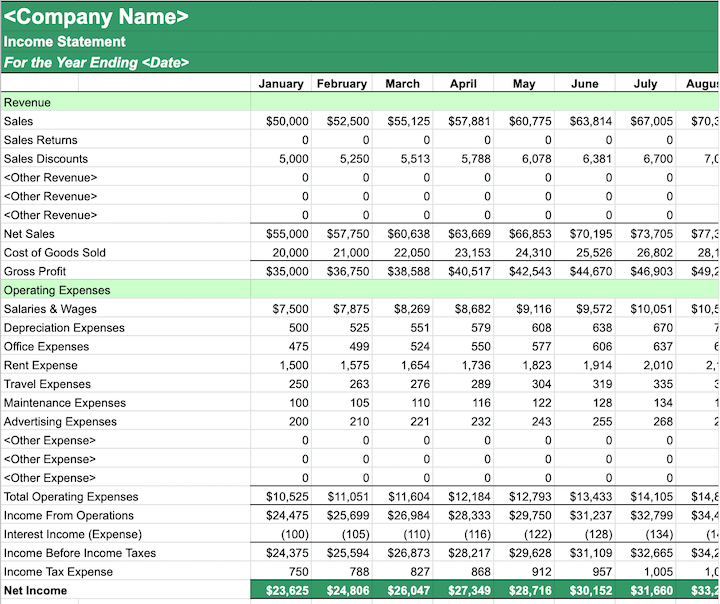

Right after collecting all the facts previously mentioned, it’s time to assemble all the parts of the jigsaw puzzle to make perception of it all. That suggests creating a income and decline (P&L) or earnings assertion, like the a person revealed under.

You’ve most likely listened to of a P&L statement, and it’s probably supplying you a headache just thinking about it. But it does not have to be that way. That is since you’ve already accomplished the heavy lifting by collecting all the knowledge details. All that’s left is to sum up your profits streams and subtract the complete of all your expenses for the month.

With any luck ,, you are going to get a favourable determine in the end—in which situation, congratulations simply because you’re making a income. If you get a damaging figure, don’t fret about it. Why? You now know where your dollars is likely and can make the needed changes to change a earnings.

Small company funds templates

Irrespective of whether you are seeking to enhance a little advertising and marketing price range or get a business grasp on all of your fees, there’s something in this record of tiny organization advertising and marketing spending plan templates for every person.

Capterra

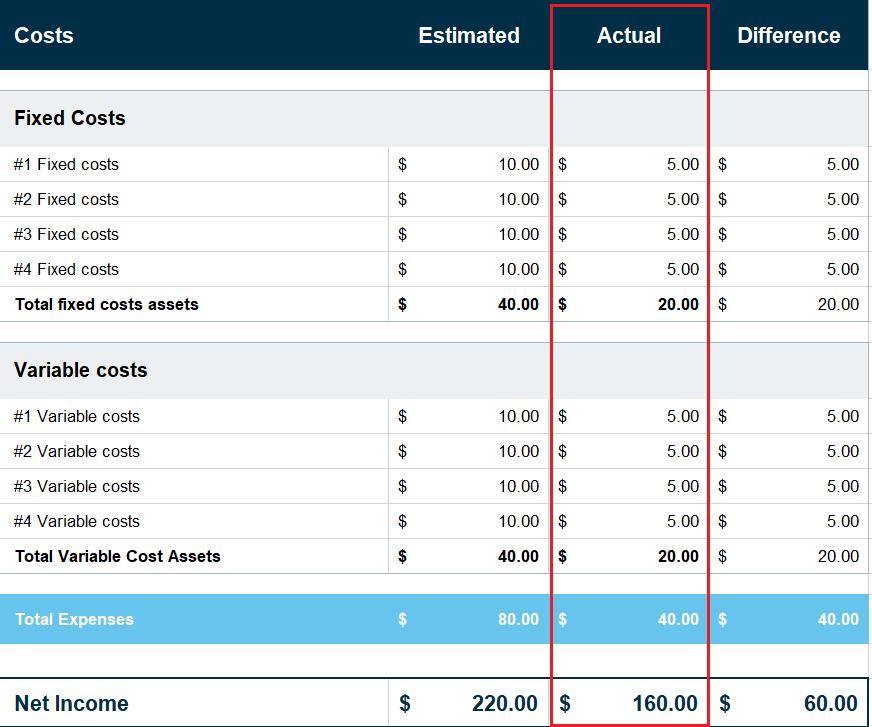

Capterra’s smaller business enterprise finances template is simple to use and employs all of the parts we described earlier mentioned, like fastened charges, variable expenditures, income, and gain. You can use it in Excel or Google Sheets.

Template Lab

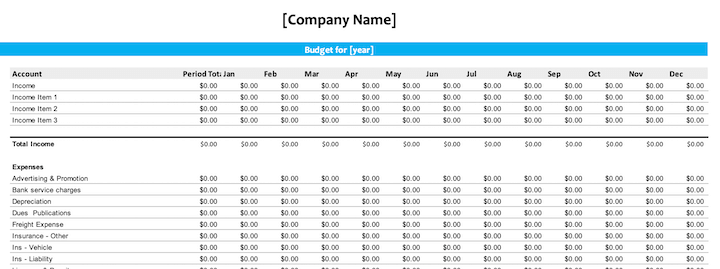

Template Lab’s compact business enterprise finances template portion presents you a couple of distinct templates to work with, in term doc and spreadsheet format. These templates are practical for itemizing your charges.

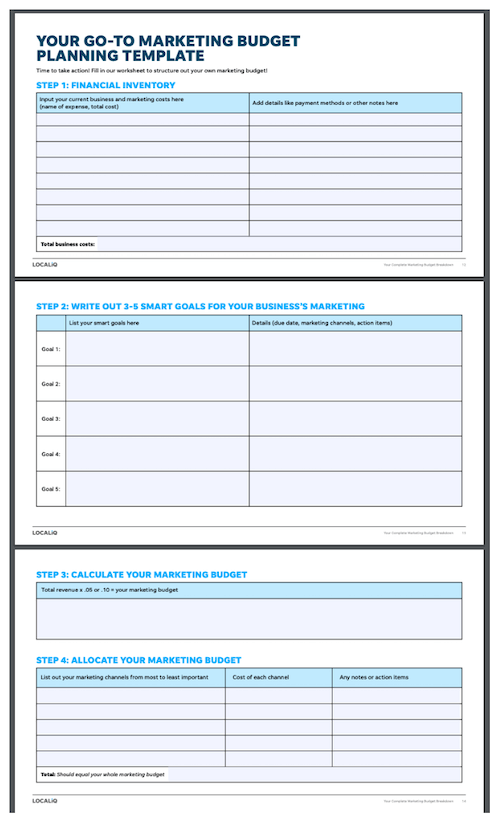

LocaliQ’s internet marketing finances template

LocaliQ’s Comprehensive Manual to Internet marketing Budgets not only gives you with a internet marketing spending budget template, but also walks you via the marketing finances fundamental principles.

Useful Spreadsheets’ Cash flow assertion template

To generate an cash flow statement, you can use this income statement Google Sheet template to input your profits and charges.

Create your little organization spending plan right now

No matter if it’s your to start with or second enterprise, mastering tiny organization budgeting essentials is the critical to accomplishment. Follow these measures to create a modest enterprise finances:

- Generate independent small business and personalized accounts.

- Set aside income for an unexpected emergency fund.

- Recognize your profits streams.

- Determine your fixed charges.

- Establish your variable expenditures.

- Generate a earnings/reduction revenue assertion.

With a little enterprise budget, you are going to have insight into how your company is accomplishing, which will then enable you make the correct financial selections to prosper. Very good luck!

About the creator

Jon Morgan is the founder of two thriving e-commerce and SaaS companies. He’s passionate about sharing what he has discovered from doing work with business enterprise homeowners by way of Enterprise Smarter.

More Stories

Sales Build in November as Inventories Grow

A Two-Way Communication Tool for Teachers

My 50th birthday celebrations in Amsterdam